Introduction

Car Insurance costs keep rising across the UK, yet drivers still chase Cheap Car Insurance wherever they can find it.

However, new automotive technology could change everything.

Specifically, self-driving vehicles promise fewer accidents, smarter safety, and possibly the cheapest car insurance many drivers have hoped for.

So here’s the big question.

Will automation genuinely reduce premiums, or will insurers simply shift the costs elsewhere?

And here’s the kicker.

Technology rarely reduces costs instantly.

Instead, markets adjust slowly.

Insurance Costs Explained: Why Car Insurance Costs Keep Climbing

Car Insurance pricing reflects risk first, profit second.

Consequently, accident rates directly influence premiums.

Meanwhile, modern vehicles cost more to repair.

Even minor bumps now involve sensors, cameras, and software calibration.

Naturally, insurers pass those costs on.

For a broader overview, see Cheap Car Insurance comparisons across the UK market.

That said, price inflation plays a major role too.

Parts cost more.

Labour costs more.

Claims payouts therefore increase steadily.

And here’s the reality.

Drivers often notice the rise only at renewal.

How Technology Complicates Cheap Car Insurance

Modern cars promise safety.

However, they also increase repair complexity.

Consequently, insurers balance reduced accident risk against expensive claims.

Advanced driver assistance already influences pricing.

Telematics policies illustrate this clearly.

If you’re curious, explore telematics car insurance for current savings potential.

Still, full autonomy introduces a different equation.

Responsibility may shift away from drivers.

Manufacturers could carry more liability.

And that changes everything.

Now here’s where it gets interesting.

Insurance may evolve faster than driving habits.

What Self-Driving Cars Actually Mean For Insurance

Not all “self-driving” cars drive themselves completely.

In reality, automation exists on a spectrum.

Some systems assist drivers only.

Others aim for full autonomy eventually.

The distinction matters enormously for insurers.

Because partial automation still involves human error.

And human error drives most claims.

If you want policy breakdowns, see car insurance options for current UK coverage types.

Nevertheless, insurers already monitor emerging trends.

They collect driving data constantly.

They analyse behavioural patterns.

And therefore they refine risk models continuously.

Let that sink in.

Insurance pricing increasingly follows data, not guesswork.

Will Fewer Accidents Really Mean Cheaper Insurance?

Logically, fewer crashes should reduce premiums.

Therefore, autonomous safety systems create optimism.

Emergency braking already lowers collision frequency.

Lane assist reduces drifting accidents.

Predictive software reacts faster than humans.

Consequently, claims frequency could decline significantly.

To understand cost calculation factors, see how insurers calculate insurance.

However, optimism alone does not guarantee savings.

Repair costs still matter.

Software failures create new liabilities.

Cybersecurity risks also concern insurers.

And here’s the twist.

Safety gains sometimes increase claim complexity.

The Short-Term Reality For UK Drivers: Insurance Costs Explained

Many drivers expect instant premium drops.

Unfortunately, markets rarely move that quickly.

Insurers need years of reliable data first.

Meanwhile, mixed traffic complicates risk analysis.

Human drivers still dominate UK roads.

So accidents remain unpredictable.

If budget matters now, explore very cheap car insurance options available today.

Additionally, regular comparison still saves money.

Switching providers often reduces renewal costs.

Understanding trends also helps negotiation.

Here’s the bottom line.

Technology helps, but timing determines savings.

Why Self-Driving Cars Might NOT Cut Car Insurance Costs Immediately

However, optimism needs balance.

Because technology rarely lowers prices overnight.

Repair complexity remains the biggest obstacle.

Autonomous sensors cost serious money.

Even small collisions trigger expensive recalibration.

Consequently, insurers remain cautious.

If you want cost trends explained, see Has car insurance risen?.

And here’s the catch.

Safety improvements sometimes increase repair bills.

So premiums may stabilise first.

Then reductions might follow later.

That transition usually takes years.

Now think about this.

Early adopters often pay more initially.

Legal Liability Could Shift Away From Drivers

Meanwhile, responsibility may move toward manufacturers.

Software errors differ from driver mistakes.

Therefore liability frameworks must evolve.

UK insurers already discuss these scenarios.

Regulators also monitor developments closely.

For clarity on coverage basics, read comprehensive vs third party insurance.

Because policy type still affects cost heavily.

Regardless of automation levels.

And here’s something overlooked.

Legal clarity takes time to establish.

So uncertainty keeps premiums cautious.

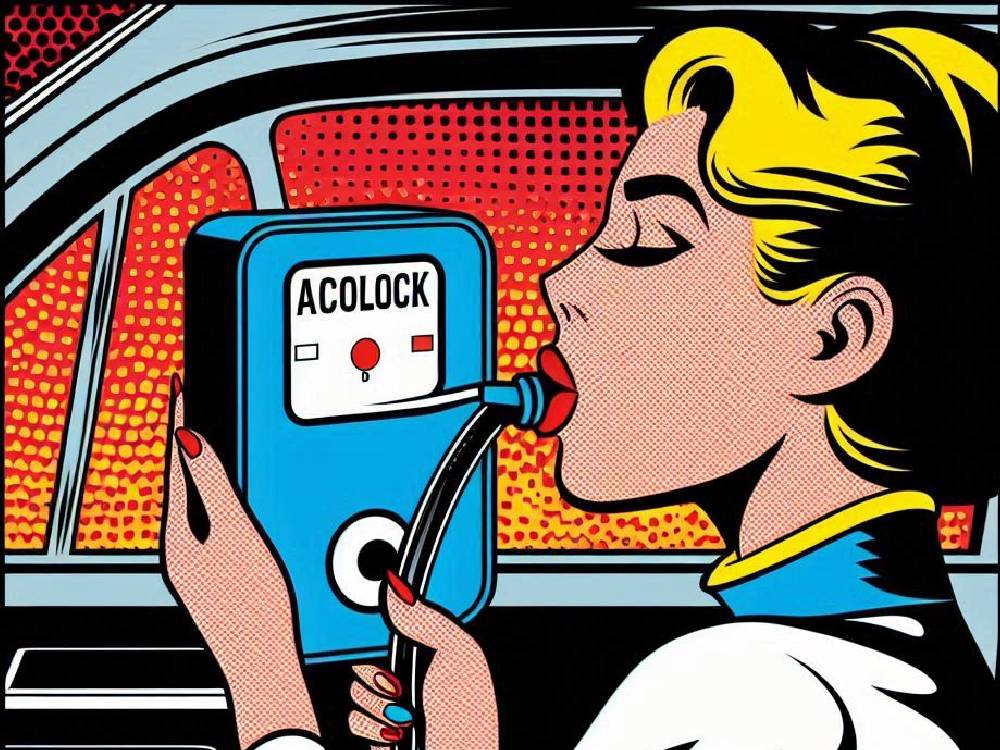

Data Will Shape Future Cheap Car Insurance

Autonomous cars generate constant data.

Driving behaviour becomes measurable precisely.

Consequently insurers gain powerful pricing insights.

Safer drivers could benefit fastest.

Higher-risk behaviour becomes harder to hide.

That said, privacy concerns also grow.

For savings strategies today, visit 5 ways to save money.

Because traditional tactics still work.

Comparison remains essential.

Negotiation still matters.

Here’s the interesting part.

Data transparency often lowers uncertainty.

And uncertainty usually increases premiums.

Electric And Autonomous Tech Often Intersect

Many self-driving prototypes are electric vehicles.

Therefore insurance trends overlap.

Battery replacement costs influence claims.

Charging infrastructure affects usage patterns.

Consequently insurers reassess risk models.

To explore this further, see car insurance electric vehicles.

Because EV insurance already evolves rapidly.

Automation will likely accelerate that shift.

And here’s another angle.

Technology adoption rarely happens uniformly.

That slows pricing adjustments.

What UK Drivers Should Focus On Today

Right now, comparison remains your strongest tool.

Because premiums vary massively between providers.

Switching insurers frequently reduces costs.

Even loyal customers benefit from checking alternatives.

If switching interests you, review switch car insurance guidance.

It often saves hundreds annually.

Also, understanding policy details helps negotiation.

Clear knowledge reduces unnecessary extras.

Confidence usually lowers quotes.

Here’s the bottom line.

Proactive drivers secure cheaper deals.

Passive ones often overpay.

Conclusion: Insurance Costs Explained

Self-driving technology promises safer roads eventually.

Therefore, long-term insurance costs could fall.

However, short-term complexity remains unavoidable.

Repair expenses stay high currently.

Legal frameworks still evolve gradually.

Consequently, immediate savings seem unlikely.

Yet the direction looks encouraging.

Technology typically improves safety steadily.

And safer roads generally mean cheaper insurance.

So what should you do?

Focus on current savings strategies first.

Compare policies regularly.

Understand your coverage thoroughly.

Stay informed about automotive innovation.

Because informed drivers secure the best deals.

If this topic interested you, explore more insights on Cheap Car Insurance, savings strategies, policy comparisons, and future insurance developments across the UK on cheapcarinsurance.co.uk, where practical guidance helps drivers find the cheapest car insurance confidently.